Russia’s recent economic difficulties have led many observers to question the economic sustainability of the nation’s current defence spending goals. The latest macroeconomic forecasts suggest a more sobering prospect.

Russia is roughly half-way through a major ten-year State Armaments Programme, which foresees the procurement of large amounts of new or upgraded weapons systems and other military hardware, across all services of its armed forces, over the period 2011-2020. The programme initially foresaw a total expenditure, for the armed forces, of 19 trillion roubles, or 647 billion US dollars at the average nominal exchange rate of 2011. This comes in addition to expenditures on personnel, exercises and operations. Can Russia muster the financial resources that these commitments require?

Russia’s military hardware on display during the annual Victory Day parade on Red Square in Moscow, Russia, 9 May 2016. © REUTERS

Developments since 2014 have not been kind to Russia’s economy. Heavily dependent on oil and gas export revenues, the nation’s currency, gross domestic product (GDP), and real living standards, all suffered substantially from the sharp fall in oil prices that occurred in late 2014. Russian GDP shrank by 3.7% in real terms in 2015, and is generally expected to fall by a further 0.8% this year, according to the October 2016 forecast of the International Monetary Fund (IMF).

A recovery is widely expected from 2017 – a modest one if oil prices remain moderate, a somewhat stronger one if oil prices rally. Western economic sanctions, meanwhile, continue to weigh down on the nation’s business and investment climate – keeping alive the West’s clear signal of disapproval towards Russia’s aggressive actions in Ukraine.

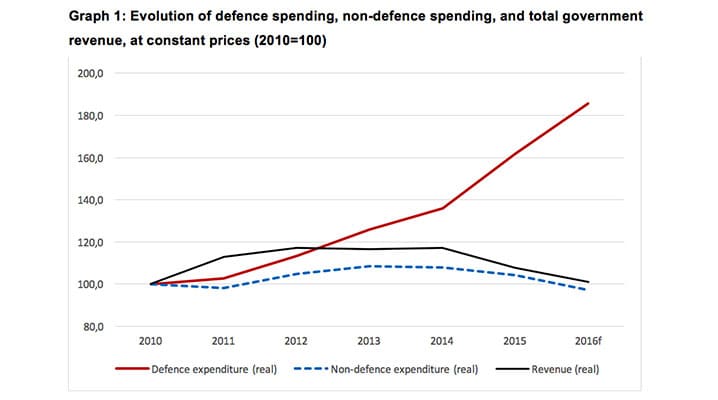

Negative GDP developments and low oil prices have naturally translated into a more challenging fiscal situation. By 2016, total government revenue will have fallen back to its 2010 level in real terms (see Graph 1). The same is true for total spending excluding defence. Defence spending, by contrast, was more than 60% higher in real terms in 2015 as compared to 2010.

The initially budgeted defence spending level for 2016 – including amendments as of 1 August 2016 and correcting for inflation – was supposed to be approximately equal to the 2015 level in nominal terms and about 8% lower in real terms. Most recently, it has been reported that the finance ministry intends to disburse an additional amount of around 678 billion roubles, corresponding to an early reimbursement, to participating banks, of state guarantees that have been used to co-finance defence procurement spending. With this late-stage amendment, total defence spending for 2016 should reach 3.89 trillion roubles. This is around 14% more than in 2015 in real terms, and more than 80% higher than the 2010 level, in real terms.

Source: IMF World Economic Outlook Database, October 2016; Russian Ministry of Finance; Russian Federal Treasury; author calculations. Data series deflated using the IMF’s GDP deflator.

Scenarios to 2020

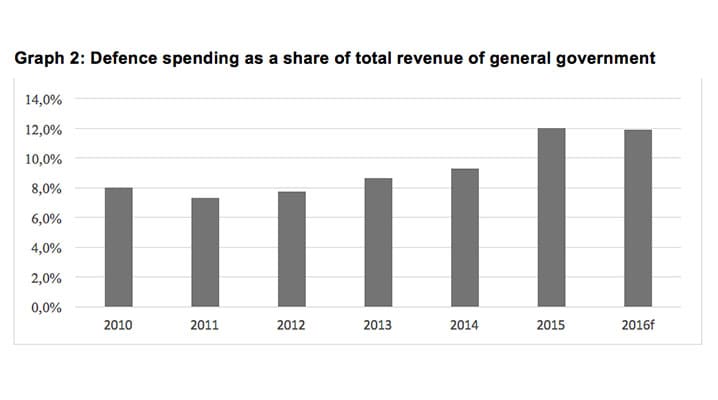

Stripping out the additional expenditure of late 2016 mentioned above, given its one-off nature, budget data suggest a stabilisation in the relative importance of defence spending (see Graph 2). After several consecutive years of strong growth, and given current and foreseeable pressures, a reasonable expectation could be that official Russian defence spending would remain at around 12% of total revenue in nominal terms over coming years.

Source: Russian Ministry of Finance; Russian Federal Treasury; author calculations. The data excludes the one-off reimbursement of defence-related state guarantees proposed in October 2016.

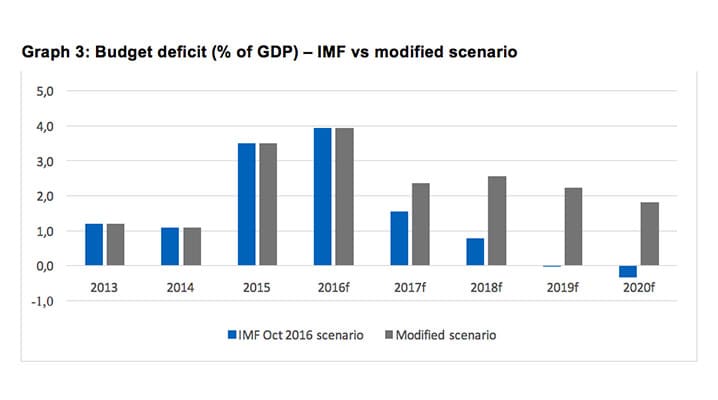

Working from that assumption, and using the IMF’s World Economic Outlook projections from October 2016, one can construct a scenario for future Russian defence spending. One can also look at the range of implications such a trajectory would have on other public spending and on future budget deficits.

This is, by nature, a problem with many moving parts. Russia could choose, as suggested by IMF projections, to aim for a small budget surplus as early as 2020. In combination with a fixed share of revenues devoted to defence, this prudent fiscal trajectory would imply consecutive annual falls in non-defence spending in real terms. As the latter could have negative impacts on living standards, and thus on domestic public opinion, an additional working assumption could be made, for instance deciding that non-defence spending should remain constant in real terms. In that case, which we shall call the ‘modified scenario’, as compared to the IMF’s scenario, future deficits would be higher (see Graph 3).

Source: IMF World Economic Outlook Database, October 2016; Russian Ministry of Finance; Russian Federal Treasury; author calculations and assumptions. A negative value indicates a budget surplus.

These higher deficits would be consistent with higher borrowing levels and corresponding increases in public debt – a policy path that may or may not be viewed favourably in Moscow. Greater fiscal efforts in other areas could however mitigate the build-up of such deficits. This could potentially include increases in taxation and partial privatisations of state-owned enterprises – however desirable these options may seem to the leadership. More generally, a stronger recovery in oil prices than the one assumed by the IMF in October 2016 would provide substantial leeway for the ‘modified scenario’ described above.

Discussions on the most desirable mix of fiscal options are ongoing in Moscow. For its part, the finance ministry currently foresees a deficit reduction trajectory that is roughly in between the IMF scenario and the modified scenario, and a reliance on higher borrowing rather than on higher taxation. The ministry is reportedly also proposing quite significant reductions in defence spending for the 2017-2019 period, down to a range of 2.7 to 2.9 trillion roubles annually, as compared to the 3.2 trillion level that had been reached in 2015. On the other hand, the same ministry has apparently proposed a new mechanism to allow discretionary increases in both defence and domestic security spending of up to 10% of total federal expenditure. The ultimate defence spending levels that may transpire in the next three years are therefore hard to predict.

Russia’s military modernisation programme

What would the modified scenario imply regarding Russia’s ambitious military modernisation programme? Public statements by senior Russian Ministry of Defence officials suggest that military procurement – as part of the nation’s annual State Defence Orders – may have amounted to roughly 60% of total (official) defence spending in recent years. These ambitious State Defence Orders are geared towards the fulfilment of Russia’s current State Armaments Programme.

Starting from the modified scenario discussed above, and using different assumptions regarding the ratio between the size of annual State Defence Orders and total defence spending over the 2011-2020 period, one can generate correspondingly different (nominal) procurement spending totals for the period as a whole. In sum, under reasonable working assumptions, it appears that total procurement spending could quite easily reach 17.5 trillion roubles, and perhaps as much as the initial target of 19 trillion roubles, over the given period. The lower total, 17.5 trillion roubles, would be equivalent to a delay of not more than one calendar year.

Of course, these considerations are strictly focused on the fiscal feasibility of the nominal spending goal of the programme, i.e. on how much money goes into it (“input side”), not on what comes out of it in terms of actual deliveries of equipment (“output side”). A more comprehensive assessment would include issues such as price increases over time for given equipment items, and speed and reliability of equipment deliveries.

These outcomes depend, in turn, on the characteristics of the defence industrial base, e.g. in terms of productive capacity, available human capital, and technological level. Barriers or delays can materialise for a range of reasons, for instance, as a result of sanctions restricting access to previously imported components. New equipment, with designs closer to the global technological frontier, may require long lead times to allow for development and testing of prototypes.

Nevertheless, recent open source assessments suggest that Russia has made substantial progress towards the goals of its current State Armaments Programme, even if some delays and challenges have (inevitably) appeared in some specific areas. Overall, a large part of the programme is likely to be fulfilled by 2020, with some rescheduling of specific procurement objectives into the forthcoming new State Armaments Programme, which should span the period 2017-2025. In any case, the analysis developed in this article suggests that Russia’s economic challenges are insufficiently severe to force any significant slowdown or curtailment of the nation’s current military modernisation effort.